Recent Articles & Reports

The Hidden Cost of Underpaying Nonprofit Staff

Research shows replacing an employee costs 50-200% of their annual salary—yet the nonprofit sector continues to underpay in the name of keeping overhead low. Here's why competitive compensation is an investment in mission capacity.

Why Your Donors Stop Giving (And What to Do About It)

With 88% of dollars coming from just 12% of donors, concentration risk is real. Here's how impact reporting becomes your most powerful major gift strategy.

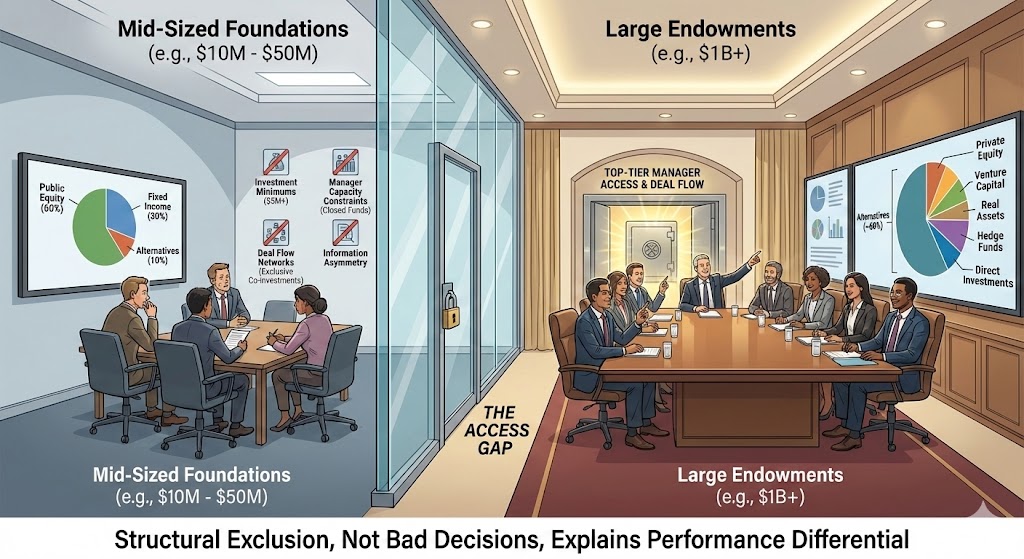

The Evolution of Philanthropic Capital: Why Foundations Are Rethinking Their Approach

Foundations and endowments are moving beyond passive grantmaking toward strategic investment models designed to compound impact over time. Discover the three trends driving this evolution.

Endowments Aren't Just for Harvard: A Practical Guide for Small and Mid-Size Nonprofits

When most people hear "endowment," they think of Ivy League universities with billion-dollar portfolios. This guide shows how organizations of almost any size can use endowments for long-term sustainability.

The Complete Guide to Donor-Advised Funds

With over $250 billion in charitable assets and annual grantmaking exceeding $54 billion, donor-advised funds have become one of the most powerful forces in American philanthropy.

Planting the Seeds of Legacy: The Planned Giving Journey

While everyone chases December gifts, most organizations miss the long-term opportunity that planned giving represents. Discover three essential elements that keep your planned giving pipeline active year-round.

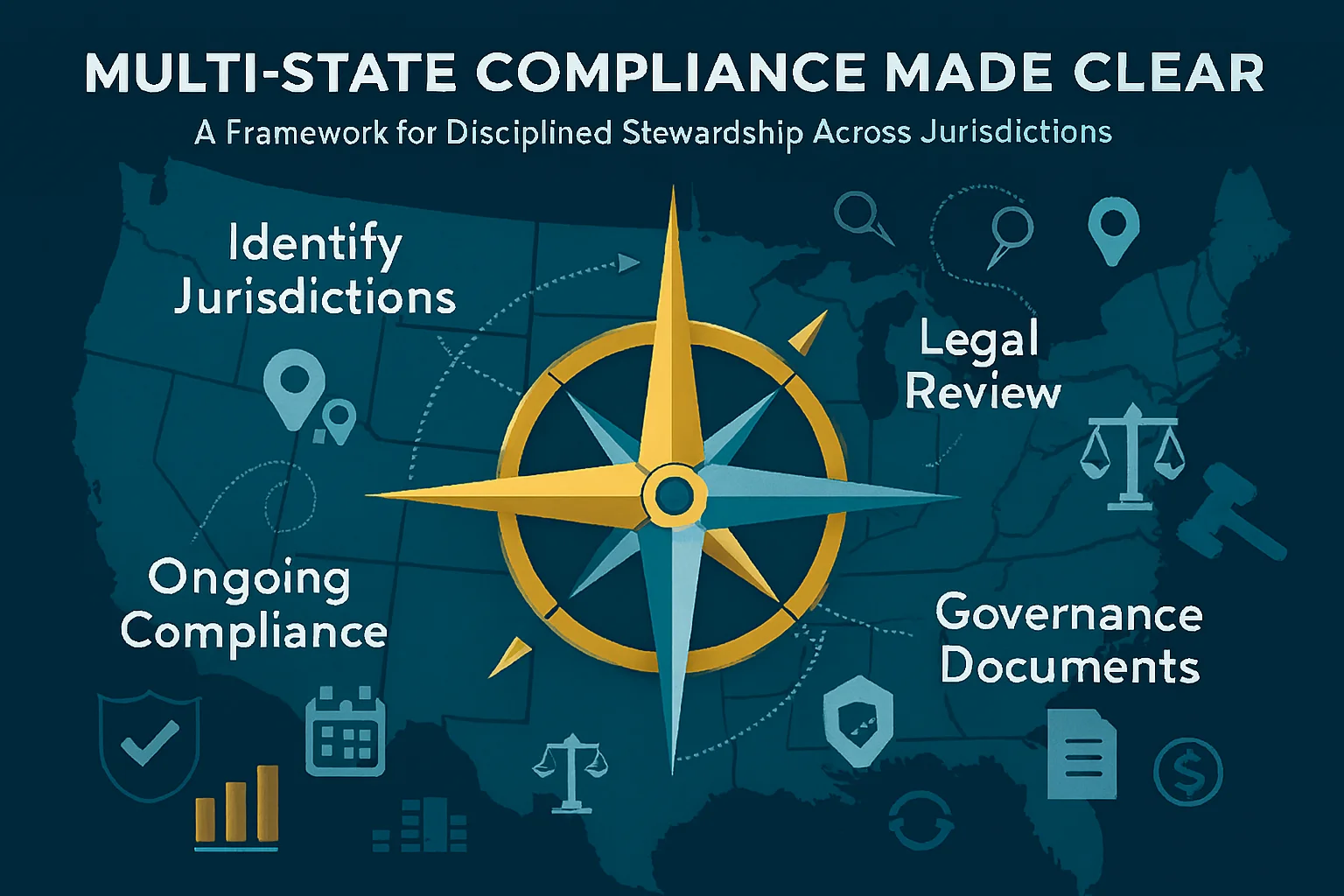

Building Your Multi-State Compliance Framework (UPMIFA Part 3)

Practical framework for building multi-state UPMIFA compliance with essential structures, documentation requirements, and proven governance frameworks for multi-state operations.

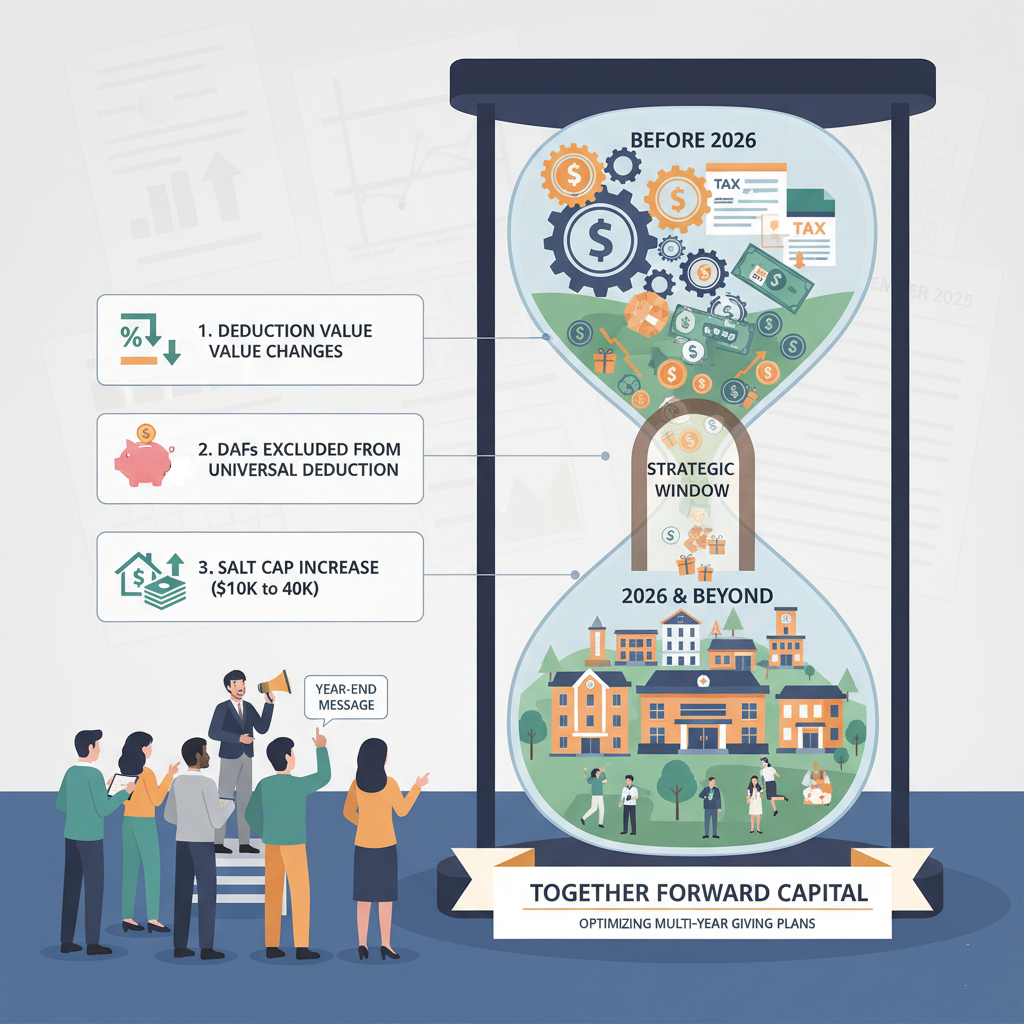

A Strategic Window for Nonprofits: What Your Board Should Know Before 2026

Major tax shifts arrive in 2026, creating a rare planning window for nonprofits. Understand how marginal rate changes, the new universal charitable deduction excluding DAFs, and the SALT cap increase reshape donor strategy and year-end giving.

Five Key State Variations Every Foundation Should Know (UPMIFA Part 2)

Understanding where UPMIFA implementations diverge and which states' laws apply to your foundation. Analysis of five critical areas where state variations create compliance challenges.

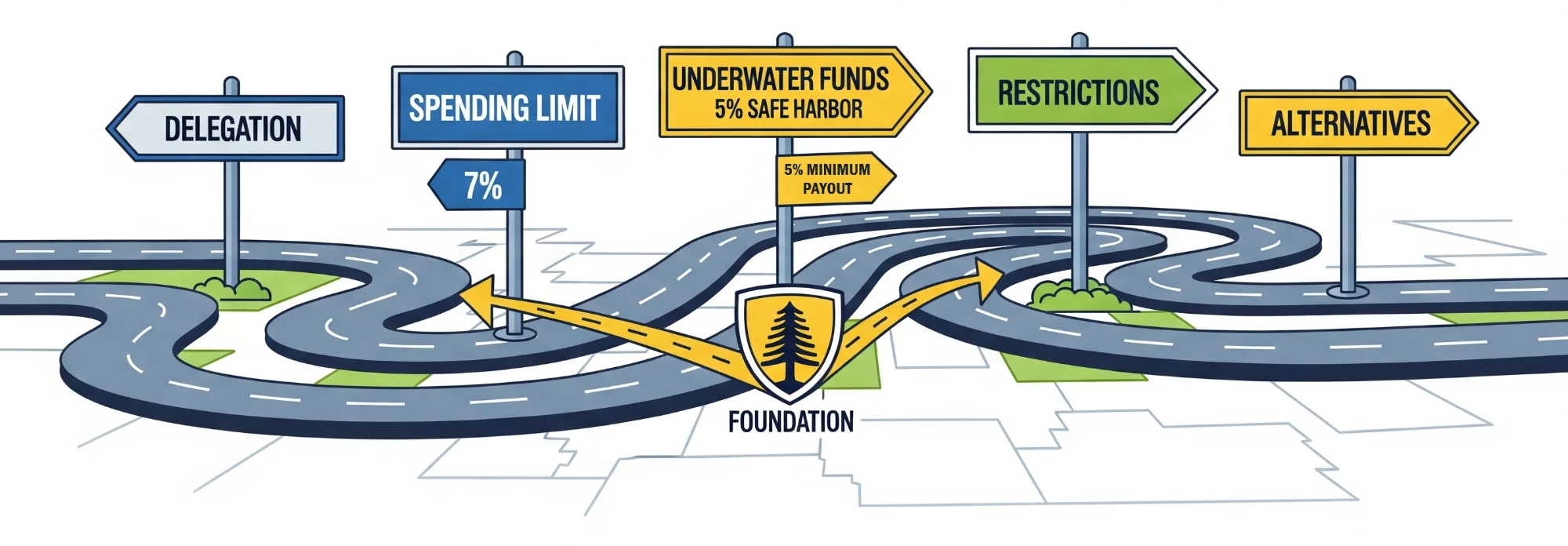

The OBBBA: Investment Strategy Implications for Foundations

How the One Big Beautiful Bill Act reshapes foundation returns, donor behavior, and excise tax exposure. Comprehensive analysis with portfolio construction and spending policy implications.

Why "Uniform" UPMIFA Isn't Uniform

Multi-state foundations face hidden compliance challenges as each state's UPMIFA version contains modifications creating unexpected governance gaps. Discover the five key areas where state variations create operational challenges.

Q4 2025 Market Outlook: Mission Resilience in Economic Transition

Comprehensive 17-page report examining charitable giving trends ($592.5B in 2024), operational cost pressures, tax law changes, and strategic investment approaches for mission-driven organizations.

Is Your Website Costing You Major Gifts?

Your organization's website is often the first touchpoint for potential major donors. Learn how digital presentation impacts donor confidence and commitment at the seven-figure level.

Nonprofit Leadership & Endowment Management Excellence

Foundation governance requires balancing fiduciary duty with mission advancement. Explore best practices for nonprofit boards overseeing endowment investment programs.

Strategic Approaches to Planned Giving Programs

Planned giving represents a critical revenue stream for sustainable philanthropy. Discover how organizations can develop and nurture legacy giving relationships that support long-term mission impact.

Understanding Fiduciary Standards in Nonprofit Investment Management

Board members and nonprofit leaders carry significant fiduciary responsibilities. Learn the standards of care, loyalty, and prudence that govern endowment investment decisions.

U.S. Equity Market Outlook: Navigating Q3 2025

The S&P 500 delivered impressive 10.5% gains in Q2, recovering from April's tariff-driven selloff. We analyze market resilience, sector valuations, and strategic positioning for the second half of 2025.

Follow Us on LinkedIn

Stay connected with our latest insights, market analysis, and thought leadership for philanthropic organizations

Follow Together Forward Capital