When most people hear the word "endowment," they think of Ivy League universities with billion-dollar portfolios and historic donor lists. The association is understandable but incorrect. Endowments are not reserved for elite institutions. They are practical financial tools that organizations of almost any size can use to build long-term sustainability.

Why This Matters for Smaller Organizations

Research associated with MIT and the University of Illinois examined more than 310,000 public nonprofit organizations and found that roughly one in nine, or approximately 35,000 organizations, maintain endowment funds. These organizations collectively manage around 800 billion dollars in endowment assets. Many are not major universities. They include community foundations, regional health providers, arts organizations, and faith-based institutions that recognized the value of establishing permanent sources of support.

The same research suggests that organizations with endowments tend to grow assets and revenues more rapidly than similar nonprofits without them. While correlation is not causation, the governance discipline that accompanies endowment management appears to strengthen long-term financial health.

Yet many nonprofit leaders assume they are too small to start an endowment. Others believe their donors would not be interested. Still others worry about complexity. These concerns are understandable, but in most cases the barriers are lower than they appear.

What an Endowment Really Is

An endowment is a pool of donated funds that an organization invests for long-term support rather than spending immediately. The goal is to preserve principal in perpetuity and distribute a prudent portion of investment returns each year.

Annual funds require constant replenishment, while endowments generate sustainable support over time.

Many organizations adopt a spending policy in the range of 4 to 5 percent of the endowment's average market value. In a typical example, a donor gives 100,000 dollars. The principal remains invested and annual distributions support mission activities. If long-term investment returns exceed annual spending, the endowment can grow over time. For example, a gift made today might still generate meaningful support for a youth services program fifty years from now.

A prudent spending policy of 4-5% annually allows endowments to grow while providing consistent support.

This structure provides something rare in the nonprofit world: consistent support that is less dependent on annual fundraising cycles, grant uncertainty, or economic fluctuations. Endowment distributions create a long-term financial baseline as other revenue sources vary.

Breaking the Stereotypes

The biggest misconception is that endowments require millions of dollars to be useful. This is not accurate. Although large endowments receive attention, many organizations maintain endowments in the hundreds of thousands or low millions.

A more practical way to think about an endowment is as a strategy rather than a status symbol. A 500,000 dollar endowment generating 20,000 to 25,000 dollars annually can fund scholarships, staff positions, program expenses, or operating needs. For many organizations, that level of flexible funding is transformative.

Another common assumption is that donors only want immediate impact. That is true for some donors, but donors with greater capacity often desire permanence and legacy. For example, a donor might establish a 250,000 dollar endowment that funds after-school tutoring in Broward County. Endowment gifts appeal precisely because they provide long-lasting support and can be integrated into planned giving conversations.

Understanding the Different Types

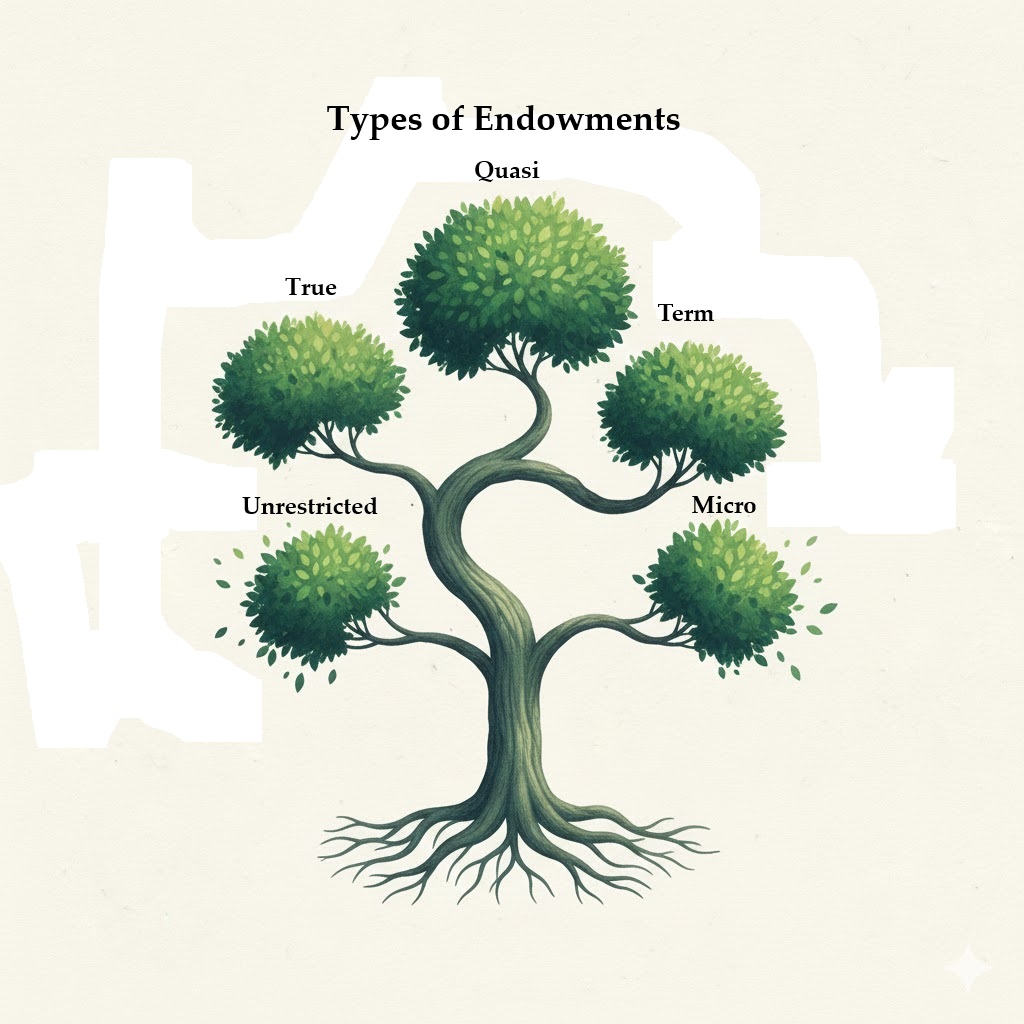

Not all endowments are the same. Understanding the key structures helps organizations match donor intent with organizational needs:

The five main endowment structures offer different levels of flexibility and permanence.

Unrestricted Endowments

Distributions can support any mission area the board deems appropriate. This type provides maximum flexibility.

Donor-Restricted or "True" Endowments

Donors specify how distributions can be used, and the organization is obligated to follow those instructions permanently, subject to applicable UPMIFA standards.

Term Endowments

Restrictions apply for a defined timeframe or until certain conditions are met. Afterward, funds may become unrestricted.

Quasi-Endowments

Board-designated funds that function like endowments but allow the board to access principal in extraordinary circumstances. Quasi-endowments provide discipline with flexibility and are often a smart starting point for smaller organizations.

Micro-Endowments

Smaller endowments, sometimes beginning at 10,000 to 25,000 dollars, that grow through additional contributions. Many organizations adopt this model to make endowment participation accessible to more donors.

What Endowments Can Support

Endowments may be designated for many purposes including scholarships and fellowships, critical staff positions, ongoing program support, facilities and capital maintenance, and operating needs. Named endowments offer a recognition opportunity that resonates with legacy-oriented donors.

Like a water wheel, endowments create a perpetual cycle of support that continues indefinitely.

Is Your Organization Ready?

Before launching an endowment initiative, evaluate three conditions:

The three foundational elements that signal endowment readiness.

Adequate Operating Reserves

Organizations should prioritize building general reserves equal to several months of operating expenses before establishing permanent endowment funds.

Strategic Planning Beyond the Near-Term

Endowment thinking aligns with ten-year horizons, not one-year budgets.

Donor Demographics

Endowment growth often relies on planned giving vehicles including bequests and charitable remainder trusts. Organizations with engaged donor bases and legacy prospects are strong candidates.

Readiness is more important than size.

A Practical Framework for Getting Started

The endowment journey begins with building reserves and continues through policy development, board commitment, and professional management.

Develop Written Policies

Create policies for investment strategy, spending rules, and gift acceptance. These documents protect both donors and the organization and are central to a compliant nonprofit endowment strategy.

Secure Board Commitment

Boards should understand fiduciary responsibilities under the Uniform Prudent Management of Institutional Funds Act (UPMIFA), which governs investment and spending for most charitable endowments in the United States.

UPMIFA provides the legal framework for prudent endowment management.

Select Professional Investment Management

Registered investment advisors are subject to fiduciary duties under the Investment Advisers Act of 1940 and must act in the best interests of their clients. Advisors experienced with nonprofit endowments and UPMIFA compliance are particularly valuable.

Build Gradually

Endowments often begin with a single leadership gift and expand through planned giving, additional contributions, or challenge opportunities. A modest endowment can still provide meaningful mission support.

The Donor Perspective

Donors who establish endowments are motivated by several factors:

Understanding what motivates endowment donors helps organizations frame compelling giving opportunities.

Permanence

Gifts continue supporting a mission long after the donor is gone.

Control

Restricted endowments allow donors to direct their philanthropy precisely.

Tax Benefits

Contributing appreciated securities may offer income tax deductions while avoiding capital gains tax, subject to applicable rules. Charitable bequests can also reduce taxable estates.

Recognition

Named endowments provide lasting visibility and legacy.

For example, a family might endow a leadership development program that carries their name in perpetuity, ensuring future generations know the origin of the support.

What to Watch For

Endowment programs require thoughtful planning. Market volatility affects distributions. Narrow restrictions may become difficult over time. Governance requires ongoing oversight. Donor communication is essential.

UPMIFA provides a legal framework for prudent investment and spending, but it does not eliminate the need for disciplined governance.

Endowment Launch Checklist

- Build operating reserves first

- Create written policies

- Secure board commitment

- Engage a qualified investment advisor

- Begin with a leadership gift

This five-step framework provides a practical starting point for nonprofit leaders exploring long-term mission sustainability.

Looking Forward

Organizations that thrive across generations think beyond annual budgets. Endowments enable that mindset. They require patience and long-term commitment, but they provide stability that few other funding sources can match.

You do not need a billion-dollar portfolio to benefit from endowment building. You need mission clarity, board support, and donors who share your long-term vision. Endowments shift the conversation from this year's budget to long-term mission stability.

The most important question is simple: where do you want your organization to be in twenty years?

Want to Go Deeper?

This article provides an introduction to endowment concepts. For comprehensive guidance on investment management strategies, governance frameworks, and measuring endowment success, explore our complete guide.

Read the Full Endowment Building Guide →Ready to Explore Endowment Strategy?

Together Forward Capital specializes in helping foundations and nonprofits build sustainable investment programs.

Schedule a ConsultationImportant Disclaimer: This article provides general information only and does not constitute legal, tax, or investment advice. Donors and organizations should consult with qualified legal, tax, and financial advisors to understand their specific situations and obligations. Investment advisory services offered through R.F. Lafferty & Co., Inc., a registered investment advisor.

© 2025 Together Forward Capital. All rights reserved.