Why "Uniform" UPMIFA Isn't Uniform

Understanding the compliance puzzle facing multi-state foundations

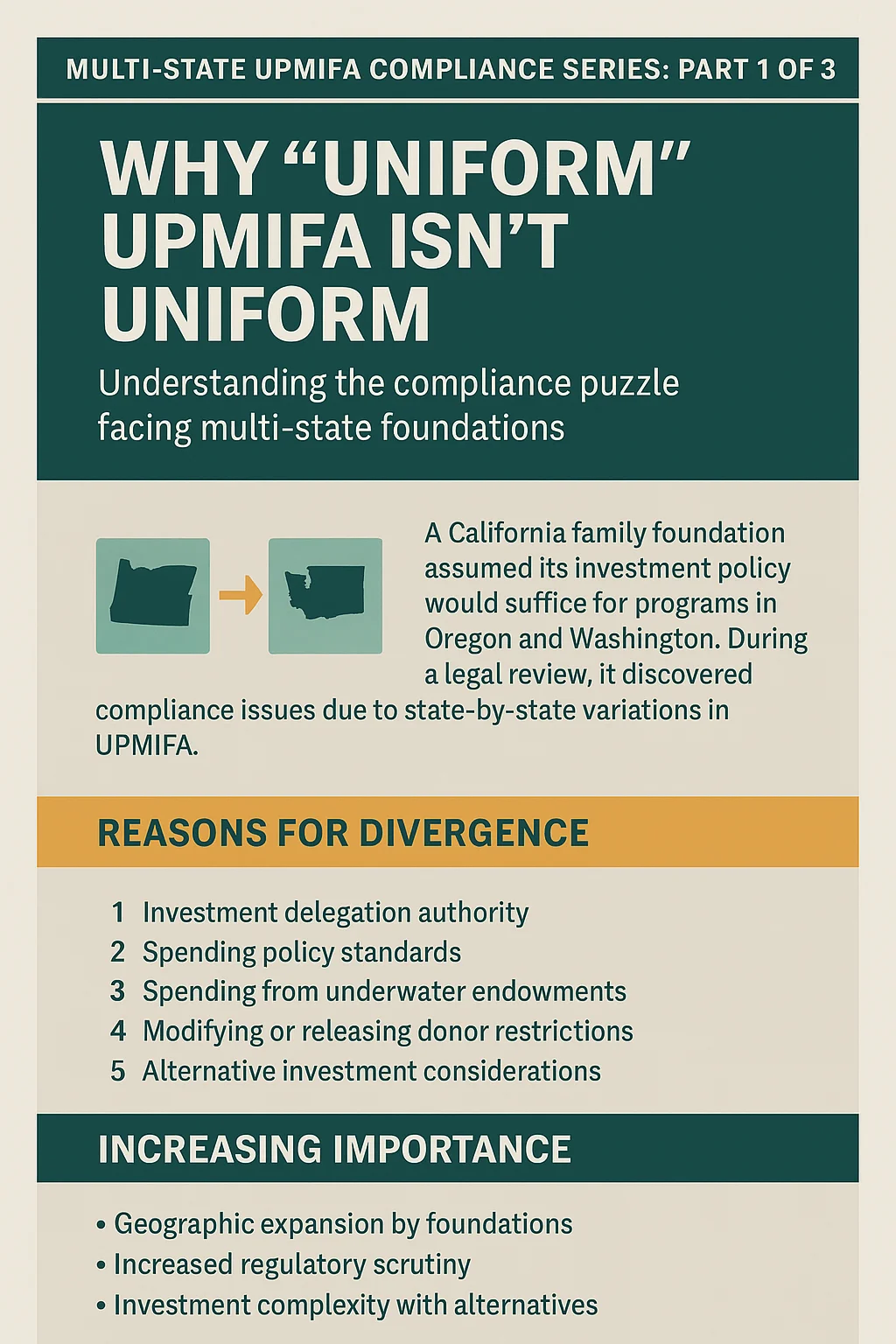

A California family foundation expanded its programs into Oregon and Washington. The board assumed their existing investment policy—carefully crafted to comply with California law—would suffice across all three states.

It didn't.

During a routine legal review, the foundation discovered that aspects of their investment governance structure, perfectly compliant in California, created potential issues under Oregon's implementation of the Uniform Prudent Management of Institutional Funds Act (UPMIFA).

The result: emergency board meetings, legal fees, and a complete rewrite of their governance documents.

The UPMIFA Promise

When the National Conference of Commissioners on Uniform State Laws approved UPMIFA in 2006, the goal was ambitious: modernize and standardize how charitable organizations manage their endowment funds across the entire country.

UPMIFA replaced the outdated Uniform Management of Institutional Funds Act (UMIFA) from 1972, addressing critical weaknesses exposed during the dot-com crash and subsequent market downturns. The new law introduced several important improvements:

- Eliminated the "historic dollar value" restriction that prevented organizations from spending from underwater endowments—a particular problem during the 2008-2009 financial crisis

- Embraced modern portfolio theory with total return investing rather than focusing solely on income

- Established clear delegation standards for investment management decisions

- Created mechanisms to release or modify outdated donor restrictions

- Articulated eight prudence factors for investment and spending decisions

These were meaningful advances. UPMIFA gave nonprofit boards much-needed flexibility to manage endowments through market volatility while preserving long-term purchasing power.

The adoption was remarkably successful: 49 states have enacted UPMIFA. Only Pennsylvania remains a holdout, continuing to operate under its own statute (Act 141).

The Reality: "Uniform" Is Misleading

Here's the challenge that catches multi-state foundations by surprise: each state legislature adopted UPMIFA with modifications reflecting local policy preferences, legal traditions, and political considerations.

Some changes are minor. Others create significant operational differences.

For foundations operating in a single state, this presents minimal complexity. Your state's version is your version—simple enough.

But for the substantial percentage of foundations operating across state lines—through program delivery, grant-making, fundraising, or asset ownership—these state-by-state variations create a compliance puzzle that many boards don't even realize exists.

Five Areas Where States Diverge

After reviewing UPMIFA implementations and working with multi-state foundations, I've identified five areas where state variations create the most significant operational challenges:

1. Investment Delegation Authority

Can your investment committee make decisions independently, or does everything require full board approval? The answer varies by state—specifically by each state's nonprofit corporation laws, since UPMIFA itself is silent on internal delegation.

2. Spending Policy Standards

Some states adopted optional provisions creating spending presumptions (like California's 7% threshold). Others didn't. Ohio went a different direction entirely with a 5% presumption of prudence. This affects how you document spending decisions.

3. Spending from Underwater Endowments

UPMIFA permits spending from underwater endowments based on prudence, but states vary in their documentation requirements and notification procedures. What's adequate in one state may fall short in another.

4. Modifying or Releasing Donor Restrictions

UPMIFA streamlined the process for addressing outdated restrictions, but states implemented different thresholds. The model act uses $25,000; California uses $100,000. Age requirements vary from 10 to 25 years depending on the state.

5. Alternative Investment Considerations

Some states explicitly authorize alternatives. A smaller number require enhanced due diligence. Most are silent. This creates varying levels of comfort for boards considering private equity, hedge funds, or other non-traditional investments.

Why This Matters More Now

Three converging trends make multi-state UPMIFA compliance increasingly critical:

Geographic Expansion

Foundations are expanding their reach. Community foundations are merging across state lines. What was once a concern only for the largest national foundations now affects organizations of all sizes. If you're registered for charitable solicitation in multiple states, you have multi-state compliance obligations—even if you don't think of yourself as a "multi-state" foundation.

Increased Regulatory Scrutiny

State attorneys general have become more active in charitable oversight, particularly regarding endowment management. High-profile enforcement actions against universities have increased attention to UPMIFA compliance across all charitable organizations. AG offices are more sophisticated about endowment law than they were a decade ago.

Investment Complexity

Foundations are increasingly allocating to alternatives and other sophisticated investments seeking enhanced returns. These allocations trigger heightened scrutiny under UPMIFA's prudence standards, particularly in states with enhanced documentation requirements. The more complex your portfolio, the more your compliance framework matters.

The Cost of Getting It Wrong

What happens when a foundation discovers compliance gaps?

At minimum: time and money spent fixing governance documents, updating policies, and obtaining new board resolutions. Often: operational friction as you implement more stringent requirements retroactively.

In worst cases: attorney general inquiries, donor concerns, and potential trustee liability for decisions made without proper authority or documentation.

The California foundation in our opening story spent six figures in legal fees and countless board hours addressing what could have been prevented with proactive compliance review before expanding operations.

What's Next in This Series

This is the first article in a three-part series on multi-state UPMIFA compliance for foundations:

- Part 1 (this article): Why "uniform" UPMIFA isn't uniform and why it matters

- Part 2 (coming next week): A detailed examination of the five key state variations and which states' laws apply to your foundation

- Part 3 (coming in two weeks): A practical framework for building multi-state compliance, common pitfalls to avoid, and your next steps

Together, these three articles will give you a comprehensive understanding of multi-state UPMIFA compliance and a roadmap for addressing it in your foundation.

The Bottom Line

If your foundation operates in multiple states—or plans to expand—don't assume your current investment policy and governance structure satisfy all relevant jurisdictions' requirements.

UPMIFA was designed to provide uniform guidance, but state-by-state modifications have created complexity that requires intentional attention. The good news: addressing this proactively is far less expensive and disruptive than discovering gaps during an attorney general inquiry or donor question.

In Part 2, we'll dive deep into each of the five variation areas and help you determine which states' laws actually apply to your foundation.

Need Help Assessing Your Multi-State Compliance?

If you're uncertain whether your foundation has multi-state UPMIFA compliance gaps, we can help. Together Forward Capital works with foundations to identify which states' laws apply, assess current governance structures, and develop compliant frameworks that maintain investment flexibility.

Schedule a confidential consultation to discuss your foundation's specific situation.