The Complete Guide to Donor-Advised Funds

Understanding DAFs: A strategic resource for foundations, endowments, and nonprofits

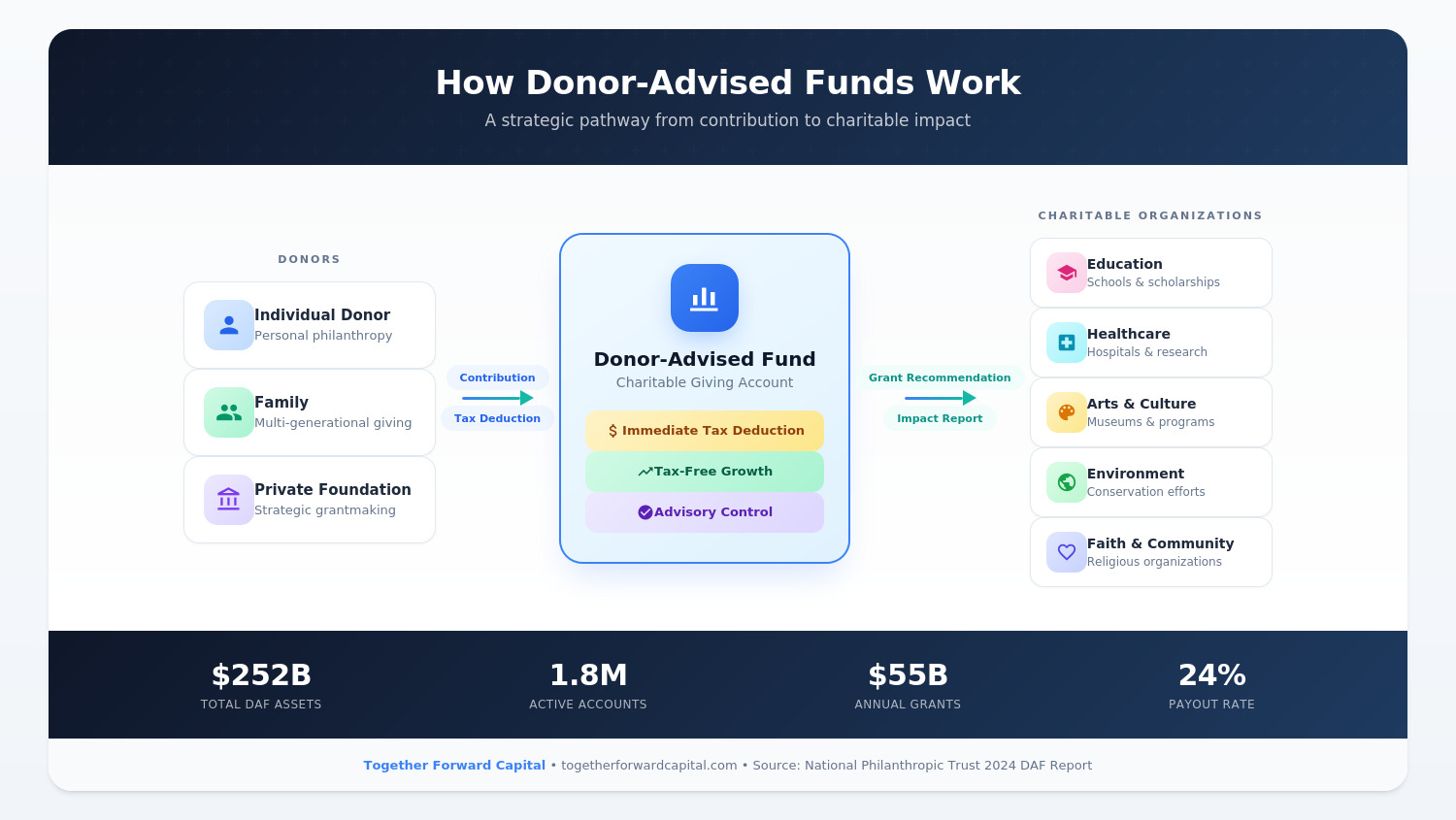

Donor-advised funds have become one of the most powerful forces in American philanthropy. With over $250 billion in charitable assets and annual grantmaking exceeding $54 billion, DAFs now account for more than 10% of all individual charitable giving in the United States.

For foundations, endowments, and nonprofit organizations, understanding this landscape is no longer optional—it's essential.

Yet despite their prominence, DAFs remain poorly understood by many philanthropic organizations. What exactly are they? Why have they grown so rapidly? And most importantly, how can your organization engage with DAFs strategically—whether as a grant recipient tapping into this massive funding pool, or as a private foundation considering DAFs as a complementary grantmaking vehicle?

This guide provides a comprehensive overview for philanthropic leaders seeking to navigate the DAF landscape effectively.

What Are Donor-Advised Funds?

A donor-advised fund is a charitable giving account that an individual, family, corporation, or organization establishes with a sponsoring organization. The donor contributes assets—cash, securities, real estate, or other property—to the account and receives an immediate tax deduction. The sponsoring organization then invests and manages the assets, while the donor retains advisory privileges to recommend grants to qualified 501(c)(3) charities over time.

The word "advisory" is key here. Once assets are contributed to a DAF, the sponsoring organization legally owns them. Donors can recommend how funds are invested and which charities receive grants, but the sponsor has final authority—though in practice, sponsors approve the vast majority of grant recommendations. When you contribute to a DAF, you're making an irrevocable gift to the sponsoring organization while retaining advisory privileges over distributions and investments.

Types of DAF Sponsors

DAF sponsoring organizations typically fall into three categories:

- National Financial Institutions: Organizations like Fidelity Charitable, Schwab Charitable, and Vanguard Charitable—the charitable arms of major financial services firms—now manage the majority of DAF assets. These sponsors typically offer low minimums, broad investment options, and streamlined digital interfaces. In 2023, national sponsors managed over $170 billion in DAF assets and distributed more than $35 billion in grants, representing 64% of all DAF dollars granted to nonprofits.

- Community Foundations: Independent charitable foundations serving specific geographic regions. These sponsors often provide personalized philanthropic guidance, deep knowledge of local nonprofits and community needs, and connections to place-based giving opportunities.

- Single-Issue Organizations: Charities that offer DAF programs focused on specific causes, faith traditions, or identity groups—allowing donors to align their giving vehicle with their values.

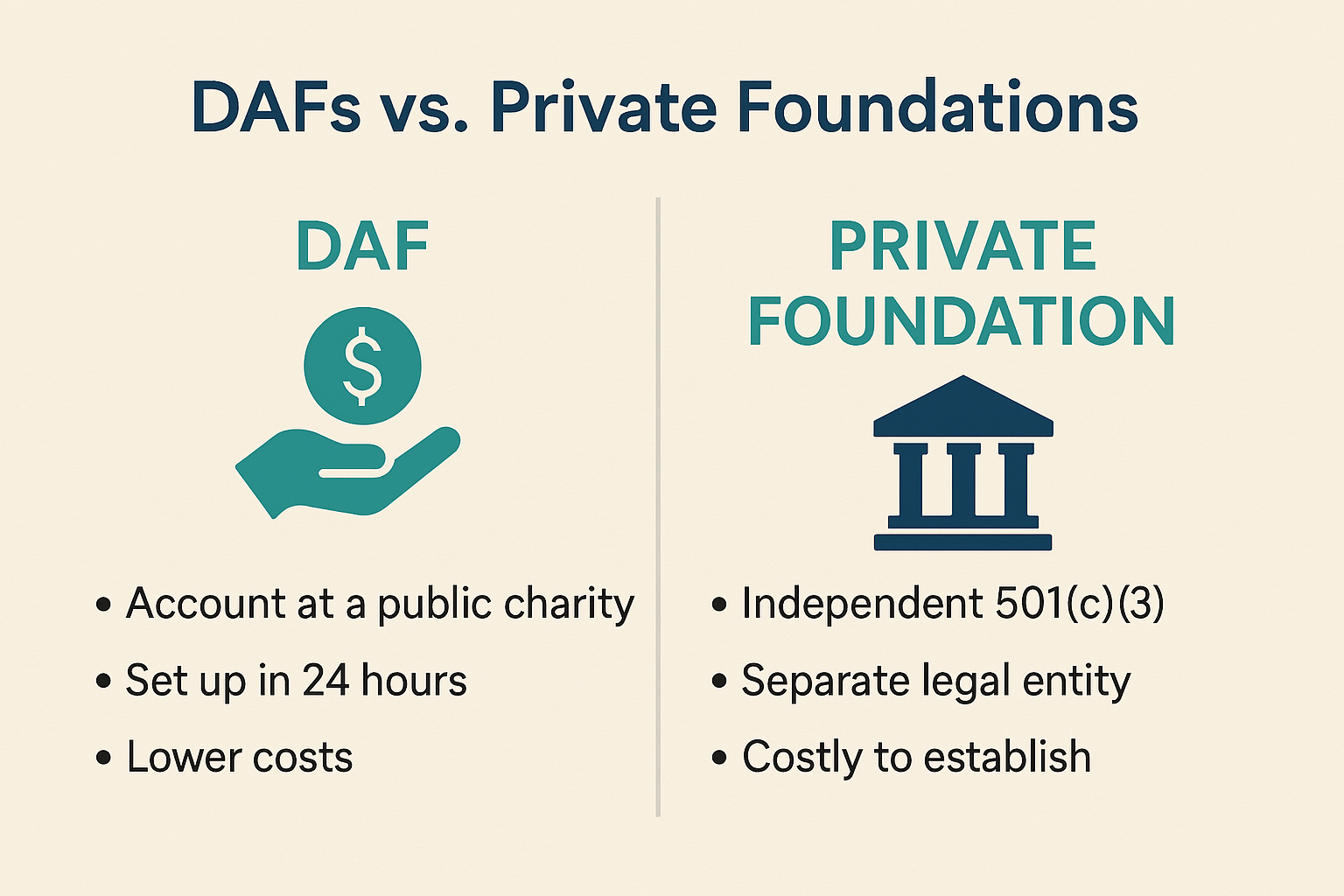

DAFs vs. Private Foundations

A common point of confusion involves the distinction between DAFs and private foundations. Both are vehicles for charitable giving, but they differ substantially:

A private foundation is an independent 501(c)(3) organization—a separate legal entity with its own board of directors, bylaws, and regulatory obligations. Foundations must file annual tax returns (Form 990-PF, which is public), hold board meetings, maintain records, and distribute at least 5% of net investment assets annually. They offer maximum control but require significant administrative effort and expense—often $15,000 or more annually in operating costs, plus months and $5,000-$25,000 to establish.

A donor-advised fund is simply an account at an existing public charity. There's no separate entity to create, no board to assemble, no tax returns to file. The sponsoring organization handles all administration. Donors can start with as little as $5,000 and set up an account in as little as 24 hours. They sacrifice some control in exchange for simplicity, lower costs, and better tax deduction limits (60% of AGI for cash versus 30% for foundations).

For many donors, DAFs offer the philanthropic benefits of a foundation without the operational complexity. This simplicity has driven much of their explosive growth.

The DAF Landscape: Key Statistics

According to the National Philanthropic Trust's 2024 DAF Report (reflecting 2023 data), the scale of DAF philanthropy is substantial:

2024 DAF Report Highlights

Breaking down these numbers further: total charitable assets reached $251.52 billion (up 9.9% from $228.92 billion in 2022), with 1,782,281 DAF accounts—a number that has nearly doubled over the past five years. The average account size is $141,120. Grants to nonprofits totaled $54.77 billion (nearly doubled from $28 billion in 2019), while contributions to DAFs reached $59.43 billion. The payout rate of approximately 24% has consistently remained at or above 20% every year on record.

DAF grantmaking has grown at a compound annual rate of 17.8% from 2019 to 2023. While contributions dipped 21.7% in 2023 after record highs during the pandemic, the overall trajectory remains strongly upward. For context, DAF grants now represent almost half (48%) of the value of all private foundation grants and expenditures combined.

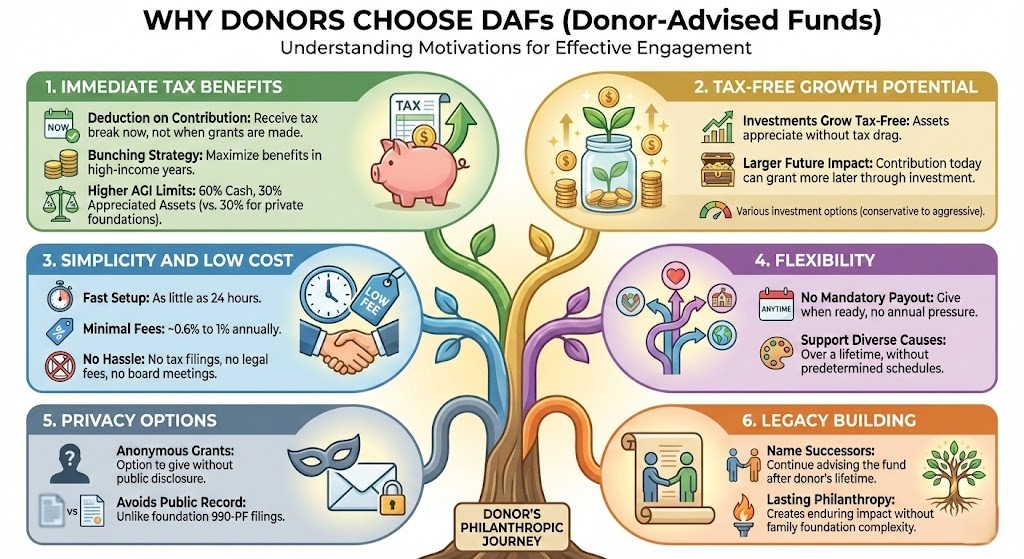

Why Donors Choose DAFs

Understanding what motivates DAF holders helps organizations engage them more effectively. The primary appeals include:

- Immediate Tax Benefits: Donors receive a tax deduction when they contribute to their DAF—not when grants are eventually made. This allows donors to "bunch" contributions in high-income years for maximum tax benefit while spreading grants over time. DAF contributions qualify for deductions up to 60% of adjusted gross income for cash (versus 30% for private foundations) and 30% for appreciated assets.

- Tax-Free Growth Potential: Assets in a DAF can be invested and grow tax-free. A contribution today could appreciate substantially before being granted, allowing donors to give more than they originally contributed. Many sponsors offer investment options ranging from conservative to aggressive growth strategies.

- Simplicity and Low Cost: Opening a DAF takes as little as 24 hours—some sponsors have no minimum contribution requirement. Administrative fees typically run 0.6% to 1% of assets annually, with no legal fees, no tax filings, and no board meetings required.

- Flexibility: Unlike private foundations, DAFs have no mandatory annual payout. Donors can give when ready, supporting different causes over their lifetime without predetermined schedules.

- Privacy Options: DAF grants can be made anonymously—unlike foundation grants, which are matters of public record through 990-PF filings.

- Legacy Building: Many sponsors allow donors to name successors who can continue advising the fund after the original donor's death, creating a lasting philanthropic legacy without the complexity of a family foundation.

Receiving DAF Grants: Strategies for Nonprofits and Foundations

For most philanthropic organizations, the primary opportunity with DAFs is as a grant recipient. With over $250 billion in charitable assets awaiting distribution, DAFs represent one of the largest—and most accessible—pools of philanthropic capital available.

Why DAF Holders Are Valuable Donors

DAF holders are, by definition, committed philanthropists with meaningful financial capacity:

- High-Capacity Giving: The average DAF account holds over $141,000. Identifying DAF holders in your donor base is a form of prospect research—these individuals have both philanthropic intent and financial means.

- Strong Retention: Research indicates that nearly 80% of DAF grants are not a donor's first gift to a particular nonprofit. DAF donors who support your organization tend to give repeatedly.

- Revenue Diversification: Adding DAF grants as a funding stream supports financial sustainability and reduces dependence on any single source.

- Planned Giving Crossover: DAF holders may also name your organization as a beneficiary for remaining funds upon their passing, creating planned giving opportunities.

Five Strategies for Securing More DAF Grants

Since DAFs have no mandatory distribution requirement, grant requests can slip donors' minds. Organizations that actively engage DAF holders and simplify the giving process capture more of this funding:

- Make DAF Giving Easy: Add DAF-specific information to your donation page with clear instructions for requesting grants. Include your organization's legal name and EIN prominently—DAF sponsors verify recipient organizations, and discrepancies can delay or prevent grants. Some organizations use DAF widgets that connect donors directly to their sponsor's grant portal.

- Promote DAF Giving Proactively: Include DAFs in your fundraising communications alongside cash, stock, and planned giving options. Add language like "You can support our work through your donor-advised fund" to appeals and acknowledgments. Many donors simply need to be reminded that their DAF is an option.

- Demonstrate Tangible Impact: DAF holders are strategic givers who want to understand exactly how their grants advance your mission. Send personalized impact reports with specific, measurable outcomes—not generic thank-you letters. Show them the difference their support makes.

- Identify DAF Holders in Your Donor Base: Use prospect research to identify current and potential DAF holders. Grants arriving from Fidelity Charitable, Schwab Charitable, or community foundations are indicators. Flag these donors for targeted cultivation and personalized outreach.

- Steward DAF Donors Intentionally: Once you receive a DAF grant, don't let the relationship go dormant. Regular updates, engagement opportunities, and expressions of gratitude encourage future grants. Remember: DAF donors choose when and whether to give—your job is to stay top of mind.

DAFs as a Grantmaking Tool for Private Foundations

While most discussions of DAFs focus on individual donors, private foundations are increasingly incorporating donor-advised funds into their philanthropic strategies. Rather than choosing between a foundation and a DAF, sophisticated grantmakers often use both vehicles in combination.

How It Works

Private foundations can make grants to donor-advised funds because DAF sponsors are 501(c)(3) public charities. A foundation can contribute assets to a DAF, and those contributions count toward the foundation's required annual distributions. The foundation (or designated individuals) then serves as the DAF advisor, recommending grants to operating charities over time.

Strategic Benefits for Foundations

- Meeting Distribution Requirements Flexibly: Foundations must distribute at least 5% of net investment assets annually. In years when the foundation hasn't identified specific grant recipients, a contribution to a DAF satisfies this requirement while keeping funds committed to charity for future deployment.

- Anonymous Grantmaking: Foundation grants are matters of public record through Form 990-PF; DAF grants can be completely anonymous. Foundations may use a companion DAF for grants where they prefer discretion—avoiding solicitation from similar organizations or supporting causes outside their public focus.

- Reduced Administrative Burden: DAF sponsors handle investment management, recordkeeping, tax receipting, and grant processing. For foundations seeking to expand philanthropic reach without adding staff or complexity, a DAF provides turnkey infrastructure.

- Lower Investment Costs: Some foundations use DAFs to access quality investment options at lower cost, particularly through sponsors like Vanguard Charitable with competitive fee structures.

- Succession Planning: If foundation trustees wish to step back from administrative duties while remaining involved in grantmaking, a DAF can provide a transition path. The foundation can distribute assets to a DAF advised by a departing trustee, allowing continued philanthropic engagement without governance responsibilities.

Converting a Foundation to a DAF

For foundations finding administrative, legal, and accounting responsibilities burdensome, full conversion to a donor-advised fund offers a path to continued philanthropy with reduced overhead. The foundation's assets can be transferred to a DAF, the original foundation name can often be preserved, and former trustees can continue as fund advisors with grant recommendation privileges.

This approach may appeal to foundations that primarily make grants to public charities, have experienced trustee transitions, or simply prefer to focus on grantmaking rather than administration.

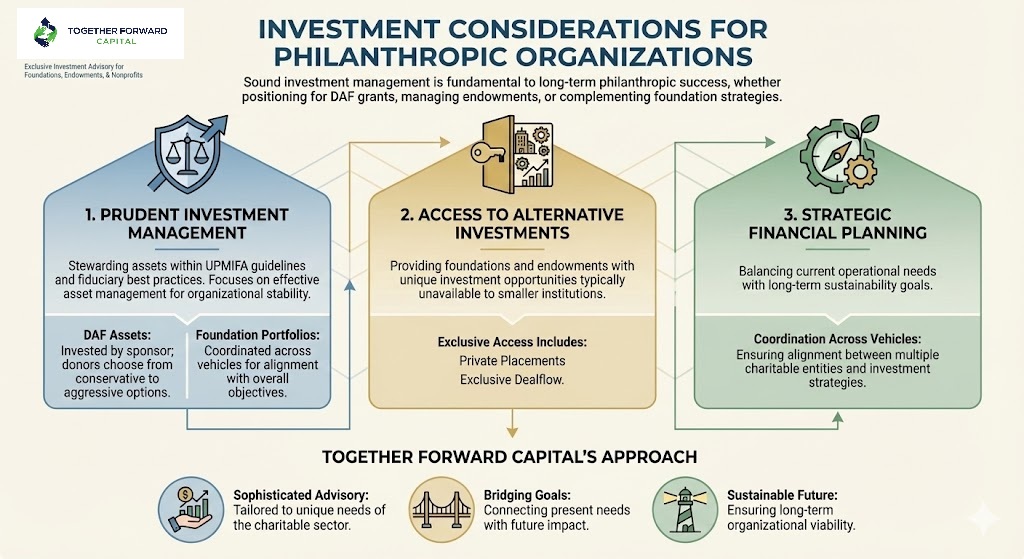

Investment Considerations for Philanthropic Organizations

Whether your organization is positioning itself to receive DAF grants, managing endowment assets, or considering how a DAF might complement your foundation's grantmaking strategy, sound investment management remains fundamental to long-term philanthropic success.

DAF assets are invested by the sponsoring organization, with donors typically choosing from a menu of investment options ranging from conservative to aggressive growth strategies. For foundations maintaining their own investment portfolios alongside a DAF, coordination across vehicles ensures alignment with overall objectives. For nonprofits and endowments managing operating reserves and long-term funds, investment strategy directly impacts organizational sustainability.

At Together Forward Capital, we work exclusively with philanthropic organizations—foundations, endowments, and nonprofits—to provide sophisticated investment advisory services tailored to the unique needs of the charitable sector:

- Prudent Investment Management: Working within UPMIFA guidelines and fiduciary best practices to steward organizational assets effectively.

- Access to Alternative Investments: Our unique positioning provides foundations and endowments with access to investment opportunities—including private placements and exclusive dealflow—typically unavailable to smaller institutions.

- Strategic Financial Planning: Helping organizations balance current operational needs with long-term sustainability goals, including coordination across multiple charitable vehicles.

Conclusion: Engaging Strategically with DAFs

Donor-advised funds have become a permanent and significant feature of the philanthropic landscape. With over $250 billion in assets and annual grantmaking exceeding $54 billion, they represent both a major funding source for charitable organizations and an increasingly useful tool for strategic grantmaking.

For foundations, endowments, and nonprofits, the question is not whether to engage with DAFs but how:

- As a recipient: Actively promote DAF giving, make the process easy, identify DAF holders in your donor base, and steward these high-value relationships intentionally.

- As a grantmaker: Consider whether a DAF might complement your foundation's existing structure—providing flexibility, anonymity, or administrative efficiency.

Organizations that understand DAFs and position themselves strategically will be better equipped to diversify funding, engage high-capacity donors, and fulfill their missions over the long term.

Additional Resources

- Complete Interactive Guide to Donor Advised Funds

- National Philanthropic Trust 2024 DAF Report

- IRS Guidance on DAFs

Data sources: National Philanthropic Trust 2024 DAF Report; Vanguard Charitable; Fidelity Charitable; FreeWill

Ready to Optimize Your Organization's DAF Strategy?

Whether you're looking to increase DAF grants to your nonprofit, exploring how a DAF might complement your foundation's grantmaking, or seeking sophisticated investment management for your philanthropic assets, Together Forward Capital can help.

Schedule a confidential consultation to discuss your organization's specific situation.