Building Your Multi-State Compliance Framework

A practical roadmap for foundations operating across state lines

This is Part 3 of our three-part series on multi-state UPMIFA compliance. In Part 1, we explored why UPMIFA isn't actually uniform. In Part 2, we examined the five areas where state implementations diverge and how to determine which states' laws apply to your foundation. Today, we provide a practical framework for building multi-state compliance, identify common pitfalls, and outline specific next steps.

A Practical Framework for Multi-State Compliance

Rather than attempting to navigate 49 different UPMIFA versions on your own, use this four-step framework to build a governance structure that satisfies all relevant jurisdictions:

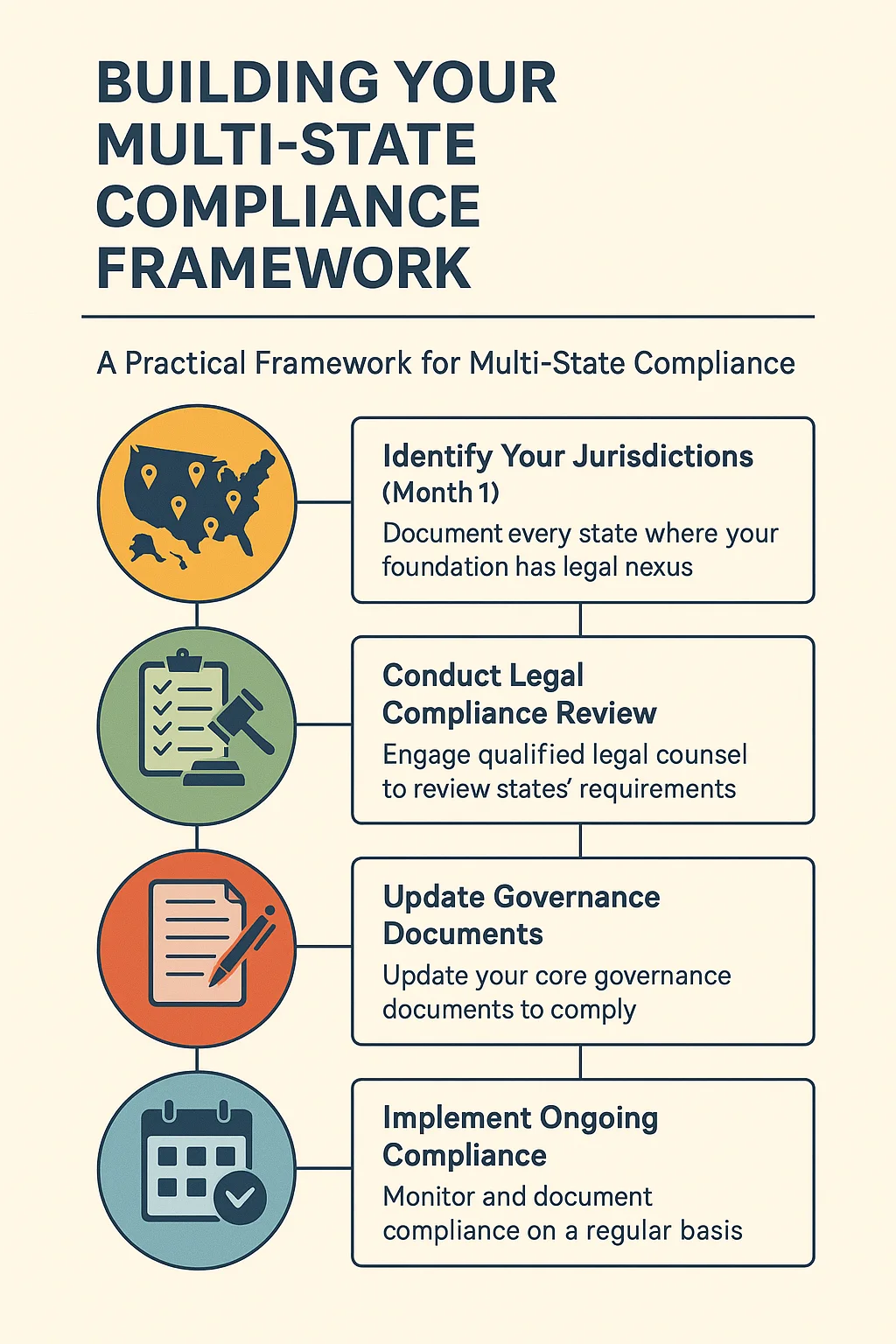

Step 1: Identify Your Jurisdictions (Month 1)

Document every state where your foundation has legal nexus. This is often more extensive than boards initially realize.

Create a comprehensive list including states where you:

- Are incorporated or registered to do business

- Are registered for charitable solicitation (don't overlook this—it's the most commonly missed nexus factor)

- Maintain offices or employ staff (including remote employees)

- Conduct substantial program activities or grant-making

- Own significant assets (real property, investment accounts)

- Received endowment gifts with geographic restrictions

For each state, confirm:

- Whether the state has adopted UPMIFA (49 have; Pennsylvania uses Act 141 instead)

- The effective date of the state's UPMIFA adoption

- Whether any significant amendments have been made since initial adoption

Common discovery: Most foundations find they have nexus in more states than they initially thought. A foundation "based in" one state often has obligations in 3-7 states when you account for solicitation registrations and program operations.

Step 2: Conduct Legal Compliance Review (Months 1-2)

Critical: Engage qualified legal counsel experienced in multi-state UPMIFA compliance. This is not a DIY project. The complexity of comparing multiple state statutes and nonprofit corporation laws requires specialized legal expertise.

Your attorney should review your states' specific requirements in each critical area:

- Delegation rules (both external and internal delegation authority)

- Spending policy provisions (percentage presumptions, documentation standards)

- Underwater endowment spending requirements (documentation, notification)

- Procedures for releasing or modifying donor restrictions (thresholds, age requirements)

- Any special provisions for alternative investments

The output should be: A clear identification of the most restrictive standard in each area. This becomes your operational baseline. For example:

- "Most restrictive delegation standard: [State X] requires full board approval for alternative investments over $1M"

- "Spending presumption: Must address 7% threshold due to California and Oregon operations"

- "Documentation: Must meet California's contemporaneous written analysis standard"

This analysis gives you the compliance framework you need without trying to track different standards by jurisdiction—you simply adopt the strictest standard everywhere.

Step 3: Update Governance Documents (Months 2-4)

Based on your legal review, update your core governance documents to comply with the strictest standards across all your jurisdictions.

Investment Policy Statement

- Address all eight UPMIFA prudence factors explicitly in your policy (not just in board minutes)

- Define delegation authority clearly: What requires board approval vs. committee discretion? Be specific about dollar thresholds, asset classes, and decision types.

- If operating in states with spending presumptions, address how your policy relates to those thresholds (e.g., "In states with 7% presumptions, any proposed spending exceeding this threshold requires documented analysis of extraordinary circumstances")

- Include enhanced due diligence procedures if required by any relevant state, and apply them to all investments of that type

- Establish protocols for investing and spending from underwater endowments, including quarterly monitoring and documentation requirements

Spending Policy

- Document your spending rate calculation methodology (typically percentage of moving average)

- Address how you'll analyze prudence for underwater endowments

- Specify notification procedures if required by any state

- Reference the eight prudence factors and how they inform spending decisions

- Include emergency spending provisions with heightened documentation requirements

Delegation Resolutions

- Formal board resolution delegating investment authority to committee or advisors

- Clear scope of delegated authority (which decisions, dollar limits, asset types)

- Specification of required committee expertise and qualifications

- Oversight and reporting requirements

- Annual reaffirmation or sunset provision

Committee Charters

- Investment committee composition, authority, and responsibilities

- Meeting frequency and documentation requirements

- Decision-making thresholds and escalation procedures

- Conflict of interest policies specific to investment decisions

Step 4: Implement Ongoing Compliance (Ongoing)

Compliance isn't a one-time project—it requires ongoing attention. Establish systems for continuous monitoring.

Quarterly activities:

- Monitor endowment values relative to original gift amounts (underwater status)

- Document prudence analysis for any spending from underwater endowments

- Review investment performance and asset allocation against policy parameters

- Ensure investment committee meeting minutes properly document key decisions

Annual activities:

- Board resolution reaffirming delegation authority and committee structure

- Legal compliance review to check for state law changes or new guidance

- Update of jurisdictional nexus list (have you expanded into new states?)

- Review and update of Investment Policy Statement and spending policy

- Documentation of spending rate decision and prudence factors considered

Documentation protocols: Maintain organized files containing:

- Current versions of all policies with adoption/amendment dates

- All delegation resolutions and committee charters

- Investment committee meeting minutes

- Quarterly endowment monitoring reports

- Annual compliance review memoranda from counsel

- Prudence analyses for significant investment or spending decisions

Common Pitfalls and How to Avoid Them

Even foundations that understand multi-state compliance often stumble in implementation. Here are the most common pitfalls I see and how to avoid them:

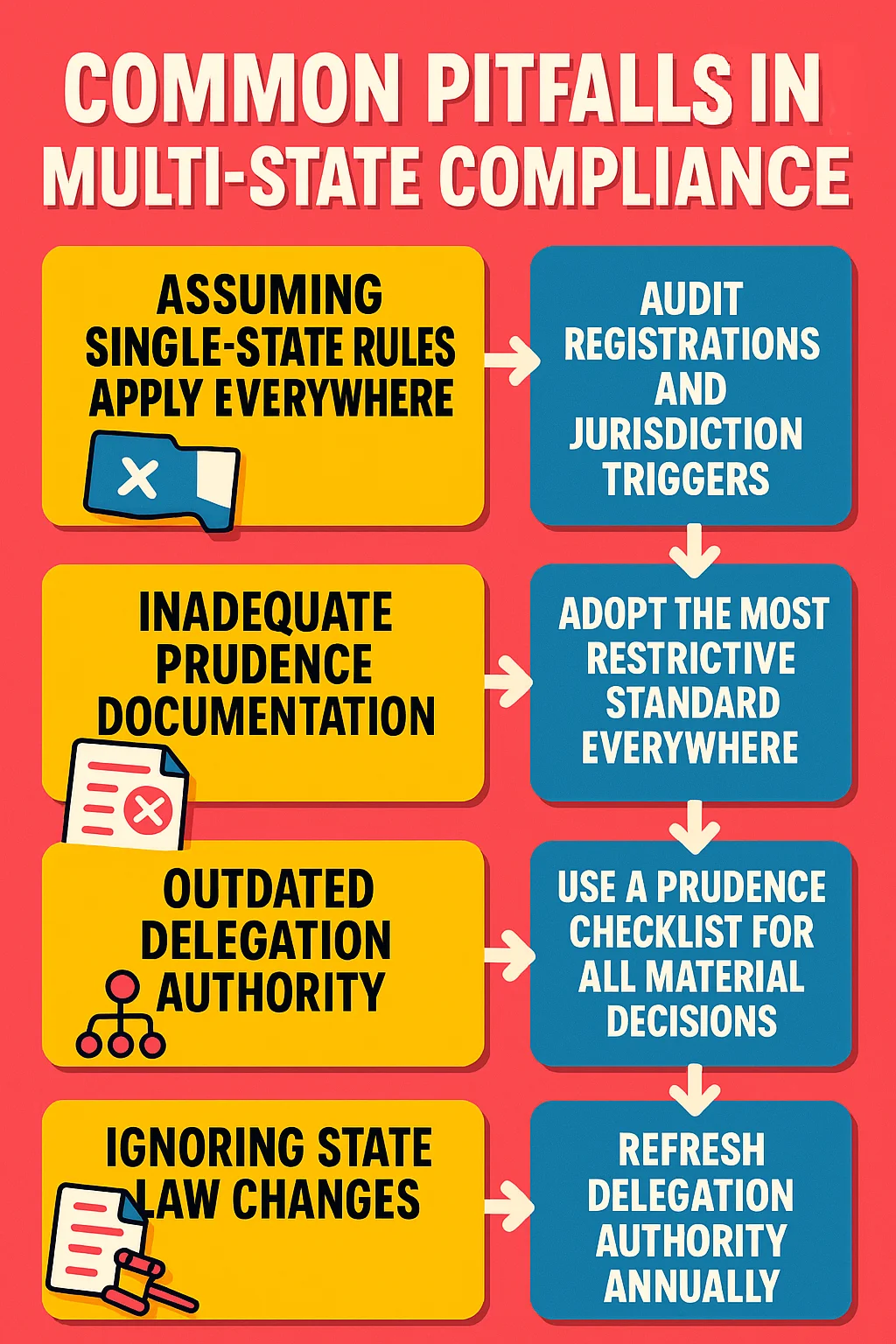

Pitfall 1: Assuming Single-State Rules Apply Everywhere

The mistake: "We're incorporated in Delaware, so Delaware UPMIFA is what matters." This is the most dangerous assumption. If you're registered for charitable solicitation in California, you have California UPMIFA obligations regardless of where you incorporated.

The fix: Complete the jurisdictional nexus analysis in Step 1 above. Don't guess—document every state where you have legal presence or operations. Then adopt the most restrictive standard across all those states.

Pitfall 2: Inadequate Prudence Documentation

The mistake: Making good investment decisions without documenting the prudence analysis. Your board might reach the right conclusion through careful deliberation, but if the analysis isn't written down contemporaneously, you've created compliance risk.

The fix: Use a prudence checklist for all material investment decisions. Before approving any significant allocation, spending decision, or policy change, work through the eight UPMIFA factors in writing. This doesn't need to be lengthy—a single page addressing each factor often suffices. But it must exist, and it must be contemporaneous with the decision.

Pitfall 3: Outdated Delegation Authority

The mistake: Operating under delegation authority established years ago without reaffirmation. Committee members change, investment strategies evolve, but the formal delegation resolution stays the same. When an attorney general inquiry comes, you discover your investment committee was never formally granted authority to make the decisions it's been making.

The fix: Annual board resolutions reaffirming committee authority and structure, with clear scope documentation. Think of these as "refreshing" your delegation documentation annually.

Pitfall 4: Ignoring State Law Changes

The mistake: UPMIFA isn't static. States periodically amend their versions, and attorney general guidance evolves. Foundations relying on decade-old policies may not reflect current law.

The fix: Annual compliance review with counsel familiar with multi-state UPMIFA requirements. Subscribe to attorney general updates in relevant states. Consider this an ongoing cost of operating across jurisdictions.

Why This Matters More Than Ever

Three converging trends make this not just "good governance" but essential:

1. Geographic Expansion Is Accelerating - Foundations are expanding their reach, community foundations are merging across state lines, and even smaller organizations are operating regionally or nationally. Multi-state operations are becoming the norm, not the exception.

2. Regulatory Scrutiny Is Increasing - State attorneys general have become more sophisticated about endowment law and more active in enforcement. High-profile actions against universities have made UPMIFA compliance a priority for AG offices nationwide.

3. Investment Complexity Is Growing - Foundations seeking enhanced returns are increasingly allocating to alternatives and other sophisticated investments. These trigger heightened scrutiny under UPMIFA's prudence standards, making documentation more critical.

Your Next Steps: What To Do This Month

If you've read this three-part series and realize your foundation may have multi-state compliance gaps, take these immediate actions:

Action 1: Create Your State List

Document every state where your foundation has nexus. Include incorporation, solicitation registration, operations, assets, and restricted gifts. You may be surprised by the length of this list.

Action 2: Review Current Policies

Pull your Investment Policy Statement, spending policy, and delegation resolutions. When were they last updated? Do they explicitly address multi-state operations? Are your delegation authorities current?

Action 3: Check Underwater Status

Identify any endowments currently below their original gift value. Have you been spending from them? Is there documented prudence analysis for those decisions?

Action 4: Schedule Legal Review

Engage counsel experienced in multi-state UPMIFA for a comprehensive compliance assessment. This is an investment in risk management and trustee protection.

The Bottom Line

Multi-state UPMIFA compliance may seem daunting, but it's manageable with the right framework. More importantly, foundations that address this proactively discover significant benefits:

- Legal protection for trustees making good-faith decisions within documented parameters

- Investment discipline that often improves long-term outcomes by forcing systematic analysis

- Donor confidence in the organization's professionalism and stewardship

- Operational clarity about who can make which decisions, reducing confusion and delays

- Access to sophisticated investments with proper documentation and prudence analysis

The foundations that thrive over the coming decades will be those that view UPMIFA compliance not as a constraint but as a framework for disciplined stewardship of philanthropic capital.

Your mission is too important to risk on incomplete compliance. If you operate in multiple states, addressing this proactively is far less expensive and disruptive than discovering gaps during an attorney general inquiry.

Series Conclusion

Thank you for following this three-part series on multi-state UPMIFA compliance. We've covered:

- Part 1: Why "uniform" UPMIFA isn't uniform and why it matters for multi-state foundations

- Part 2: Five key areas where state implementations diverge and which states' laws apply to your foundation

- Part 3 (this article): A practical framework for building compliance, common pitfalls, and your next steps

If you'd like to download the complete series as a single reference document, contact us and we'll send you the PDF version.

Let's Discuss Your Specific Situation

Multi-state UPMIFA compliance requires attention to detail and specialized knowledge. Together Forward Capital works with foundations to:

- Identify all states where your foundation has compliance obligations

- Coordinate with your legal counsel to assess current governance structures

- Develop or update Investment Policy Statements for multi-state operations

- Establish proper delegation and oversight frameworks

- Implement ongoing compliance monitoring systems

- Document prudence standards for investment and spending decisions

Our exclusive focus on philanthropic organizations means we work with multi-state UPMIFA issues regularly. We understand the nuances, know the right questions to ask, and can help you build a compliant framework that maintains investment flexibility.

Schedule a confidential consultation to discuss your foundation's specific situation.